Bookkeeping and accounting are the foundations of sound financial management for businesses and individuals. From keeping track of daily transactions to preparing detailed financial reports, these services provide essential insights that help in making informed decisions. Whether you’re a small business owner managing tight budgets or a large enterprise handling complex transactions, having access to professional bookkeeping and accounting services can make all the difference.

This list features the top 10 bookkeeping and accounting service providers in 2025, recognised for their ability to support businesses with expertise and solutions that simplify financial management and promote growth.

Why Selecting the Right Bookkeeping and Accounting Service is Essential for Long-Term Success

Bookkeeping and accounting are crucial for staying organised and achieving financial stability. Without accurate records and regular financial analysis, businesses may face cash flow issues, tax errors, and missed opportunities for cost savings. Partnering with a dependable service ensures that finances are handled efficiently, allowing you to focus on core operations.

For instance, a tech startup struggling with manual record-keeping partnered with a bookkeeping service to automate their financial processes. By implementing better systems and producing monthly reports, the service helped the startup save valuable time, avoid errors, and make more confident decisions about growth and investments.

Selecting the right service provider ensures financial transparency and helps businesses of all sizes achieve long-term stability while avoiding unnecessary stress.

1. Pearl Lemon Accounts

Pearl Lemon Accounts is a leading choice for bookkeeping and accounting services, offering a wide range of solutions to meet the needs of businesses across industries. Their team works closely with clients to provide actionable insights, improve financial organisation, and help businesses achieve their goals.

What We Offer:

- Bookkeeping Services: Daily tracking of financial transactions, expense categorisation, and account reconciliation to ensure all records are up to date.

- Tax Preparation and Filing: Support for accurate and stress-free tax submissions, including VAT management and deductions.

- Payroll Management: Timely salary processing, tax deductions, and employee benefit management.

- Cash Flow and Budgeting Assistance: Guidance on maintaining a healthy cash flow and creating realistic budgets that align with your business goals.

Why Choose Pearl Lemon Accounts?

Pearl Lemon Accounts stands out for its commitment to providing personalised services that cater to the specific challenges of each client. Their team ensures that your bookkeeping and accounting needs are handled with accuracy and transparency, empowering you to make sound financial decisions.

- Industry Expertise: The firm has worked with businesses in various sectors, offering tailored solutions to address unique financial needs.

- Cloud-Based Support: With expertise in tools like Xero, QuickBooks, and Sage, Pearl Lemon Accounts integrates modern technology to keep your records accessible and organised.

- Dedicated Service: Clients are assigned dedicated experts who provide regular updates, detailed reports, and year-round advice.

Pearl Lemon Accounts offers businesses the support they need to stay organised, reduce administrative burdens, and achieve financial clarity.

2. Bench Accounting

Bench is a top choice for small businesses looking for professional bookkeeping services. Their platform combines expert accountants with user-friendly software to ensure accurate financial records.

Key Services:

- Monthly bookkeeping and categorisation of transactions.

- Financial summaries and tax-ready documents.

- Year-end reporting to simplify tax season preparations.

3. Deloitte

Deloitte offers a range of bookkeeping and accounting services tailored to businesses of all sizes. Their global presence and industry expertise make them a trusted partner for managing financial operations.

Specialities:

- Financial reporting and analysis for informed decision-making.

- Advisory for mergers, acquisitions, and restructuring.

- Tax planning and regulatory support.

4. QuickBooks Live Bookkeeping

QuickBooks Live Bookkeeping provides accessible bookkeeping support for businesses that already use QuickBooks software. Their team ensures that financial records are maintained and ready for tax filing.

Services Include:

- Account reconciliation and categorisation.

- Monthly financial reports and insights.

- Direct integration with QuickBooks for seamless record-keeping.

5. PwC (PricewaterhouseCoopers)

PwC is recognised for its expertise in handling complex bookkeeping and accounting needs. Their team supports businesses with financial reporting and tax preparation while offering guidance for future planning.

What They Offer:

- Comprehensive financial record management.

- Advisory for improving financial processes.

- Tax preparation and filing services.

6. Xendoo

Xendoo specialises in bookkeeping for small businesses, providing a combination of expert support and intuitive software to simplify financial tasks.

Core Features:

- Weekly updates for accurate financial tracking.

- Monthly profit and loss reports.

- Tax filing and preparation support for small businesses.

7. KPMG

KPMG provides detailed bookkeeping and accounting services designed to help businesses maintain accurate records and meet financial goals. Their global expertise makes them a trusted name in the industry.

Services Provided:

- Account reconciliation and reporting.

- Payroll and expense management solutions.

- Tax filing and audit preparation assistance.

8. Pilot

Pilot focuses on bookkeeping and accounting for startups, offering customised solutions to meet the unique challenges of growing businesses.

What They Provide:

- Monthly financial reports and insights.

- Support for scaling businesses, including VC-backed startups.

- Tax preparation and audit readiness.

9. BDO International

BDO offers bookkeeping and accounting services that are ideal for businesses looking for support with financial records, tax filings, and reporting.

Key Offerings:

- Ongoing bookkeeping and financial management.

- Preparation of financial statements.

- Support for audits and tax filings.

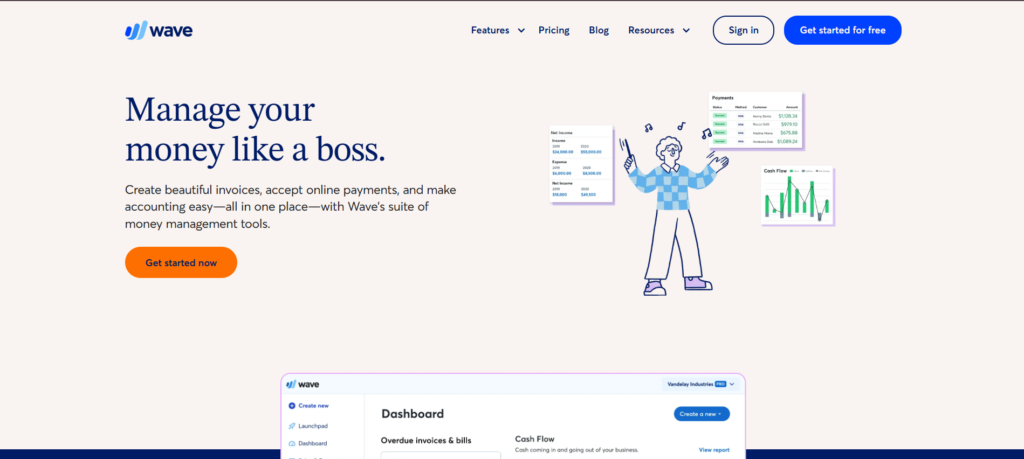

10. Wave Advisors

Wave Advisors combines professional accounting services with a user-friendly platform for small businesses and freelancers. Their affordable solutions simplify bookkeeping tasks.

Services Include:

- Bookkeeping and payroll management.

- Tax filing and year-end reports.

- Automated invoicing and expense tracking.

How to Choose the Right Bookkeeping and Accounting Service

Selecting the right bookkeeping and accounting service is crucial for maintaining organised financial records and making informed decisions. With numerous options available, it’s essential to consider factors that align with your specific business needs.

- Experience and Expertise: Choose a service provider with a proven track record in your industry. Their familiarity with sector-specific challenges ensures your finances are handled with accuracy and understanding.

- Technology Integration: Opt for a firm that works with modern accounting tools such as QuickBooks, Xero, or Sage, ensuring streamlined processes and accessible records.

- Scalability: If your business is growing, ensure the service can scale with you, offering additional support for complex financial needs as your operations expand.

- Transparent Communication: A reliable service should provide regular updates, detailed reports, and proactive advice to help you understand your financial standing.

- Customised Services: Look for a firm that offers flexible solutions tailored to your business’s specific needs, whether it’s tax preparation, payroll management, or cash flow forecasting.

By considering these factors, you can partner with a service provider that not only meets your current requirements but also supports your long-term financial goals.

FAQs About Bookkeeping and Accounting Services

1. What’s the difference between bookkeeping and accounting?

Bookkeeping involves recording daily financial transactions, while accounting focuses on analysing and interpreting that data for financial planning.

2. Why is professional bookkeeping important?

Professional bookkeeping ensures financial accuracy, helps prepare for taxes, and supports business growth by keeping records organised.

3. What tools do bookkeeping services typically use?

Common tools include QuickBooks, Xero, Sage, and Wave for managing transactions, payroll, and reports.

4. Can small businesses afford professional bookkeeping?

Yes, many providers offer cost-effective packages for small businesses, helping them save time and focus on growth.

5. How often should financial records be updated?

It’s best to update financial records weekly or monthly to maintain accuracy and ensure smooth operations.

Organize Your Finances with Confidence

Choosing the right bookkeeping and accounting service ensures your financial records are accurate and your business is prepared for future growth. Partner with Pearl Lemon Accounts for expert guidance and a customised approach to managing your finances.