Some organizations and UK-limited companies are required to pay corporation tax. Company profits are used to calculate corporation tax. Several specific expenses can be deducted, and you can take advantage of allowances that reduce your taxes.

Limited companies are subject to corporation tax in the following ways:

- Earnings are generated by trading is what you earn as a result of doing business

- Investments

- Chargeable gains from the sale of assets, including land, property, shares, and machinery

Corporate tax is paid by whom?

All limited companies in the UK are required to pay corporation tax. The income of sole traders and partnerships is not taxed as corporation tax but must be reported as ordinary income and taxable.

It is possible for organizations that are not incorporated as limited companies to pay corporation tax. Examples include:

- Associations of housing

- organizations

- Societies and clubs

- Business cooperatives

In the UK, what is the corporation tax rate?

Profits from all businesses are subject to corporation tax at 19% in the UK. In reversing a previous pledge from the previous government to reduce it to 17% from April 2020, the interest rate will remain at this level for the next two years.

For example, if a company’s taxable profit is £20,000, it would have to pay £3,800 corporation tax based on a 19% tax rate.

A company may be able to take a taxable loss and carry it back to the previous year to get some tax refunded if it made a profit the previous year.

When is corporation tax due, and how is it reported?

Corporation tax returns and detailed accounts are filed annually with HMRC by companies. HMRC usually expects to receive the corporation tax payment nine months and one day after the end of the financial year.

A company’s financial year-end depends on its formation date and can be changed depending on certain conditions.

Calculating Corporation Tax in the UK

Let’s take a moment to explain what a profit and loss account is before we explain how corporation tax is calculated.

Usually, one year is the period covered by a profit and loss account. It is calculated as income less any cost of doing business, which is a company’s profit (or loss).

It does not just reflect the cash received and paid during the period but will also reflect the timing adjustments.

Businesses offering simple services will face the following tax adjustments:

Entertainment for business

Business/client entertaining refers to inviting business contacts or clients and incurring expenses.

So long as they are actual business expenses, they can be accounted for via the company, but they are not deductible for purposes of corporation tax.

The corporation tax calculation has to take the cost back into account.

It is still an actual cost to the company, so it is still helpful to claim it back as a business expense (if you have paid for it personally) – for example if you paid £50 out of your pocket to entertain a client, to claim that back as a business expense is usually more beneficial than having to extract a further £50 from dividends.

Expenses incurred to run your business must be wholly and exclusively related to it.

If HMRC believes there is a primary motive for incurring the cost for an employee or director to gain some personal benefit, the cost may be challenged.

Capital expenditures and depreciation

Your business will be treated as a capital asset if you buy equipment and assets utilized for several years.

Your balance sheet account will record the cost, and you’ll move part of the cost from the balance sheet account to the profit and loss account as a “depreciation” charge each year.

Calculating how long to depreciate items is as simple as estimating how long you plan to use the equipment and spreading the cost over the years.

Below is a list of some common business assets and their typical depreciation periods:

- 3- to 4-year-old computer

- 2- to 3-year-old smartphone

- 4- to a 5-year-old office desk and chair

Meanwhile, corporation tax treats this purchase very differently – the relief is quite generous. You can deduct the total cost of the equipment from your profit in the year you purchase because of an allowance called the Annual Investment Allowance, a type of Capital Allowance.

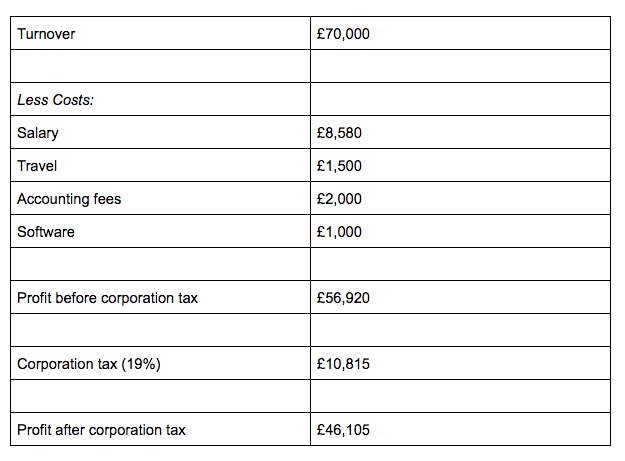

Calculation of corporation tax – Example 1

A simple service business run by a one-person limited company is shown below (e.g., a management consultant).

Also, let’s assume the company isn’t VAT registered just to keep things simple.

There are no necessary adjustments for corporation tax for the below example, so 19% of the profit is used to calculate corporation tax.

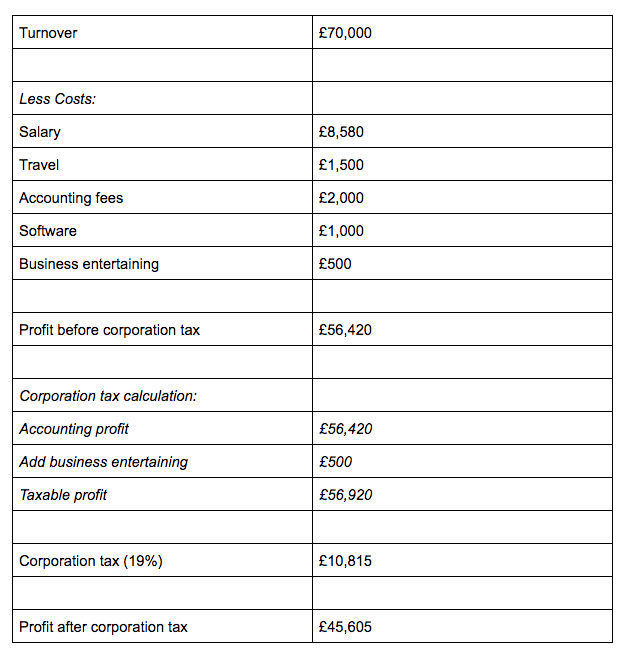

Calculation of corporation tax – example 2

In our following example, the above is the same; however, £500 of business entertaining is not deductible from corporation tax:

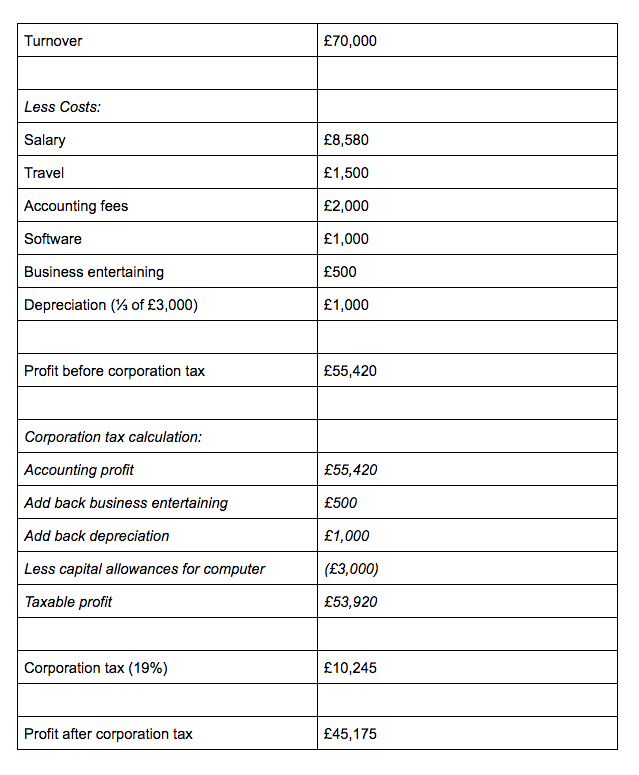

Calculation of corporation tax – example 3

Let’s consider the same business example above as a final example. Still, with an additional tax adjustment – this time, assume the business bought a computer for £3,000 at the end of the year. The computer was capitalized and will be depreciated over three years.

Dividends and corporation tax

When you calculate the available retained profits in your company for dividends, you need to factor in your company’s tax position.

If you’re assessing how much dividend headroom your company has, we’d always advise you to lean on the side of caution.

Eventually, you don’t want to be in a position where you realize you paid too many dividends – if the business did not have sufficient post-tax retained profits to support the dividends, those dividends would be deemed illegal, which could lead to profound tax implications.

Failure to make payments on time

This will result in interest being added to your account and a penalty or surcharge. To recover debts, HMRC may also take the following measures:

- Collect debts using collection agencies

- instead of taking the money from your bank or building society

- based on the sale of your belongings

- filing a lawsuit

- shutting down your business or bankrupting you

HMRC may find you filling out your tax return incorrectly. Their decision is final. Your tax bill may be reduced by 0% – 30% if it’s an accidental error. Suppose HMRC identifies it, and the percentage increases to 15% – 30%.

When HMRC discovers the error was intended but not concealed, the fine is between 20% and 70% if you inform them. When they expose it, the fine is 30% – 70%.

HMRC will charge you 30% percent – 100% if the error is deliberate and attempts have been made to conceal it, and 50% percent – 100% otherwise.

The company tax return can also be amended, but changes must be made within one year of the deadline for filing.

Conclusion

If you have any questions about how corporation tax computation adjustments could affect your business, we recommend that you speak to your accountant. The adjustments we discussed are the typical ones encountered by small, simple service businesses. However, several other adjustments could impact your business, so we recommend speaking with your accountant if you have any questions about how corporation tax computation adjustments work.