Secure Your Finances with Expert Forensic Auditing Services

When financial mismanagement, fraud, or regulatory breaches threaten your business, you need more than just an audit—you need a forensic audit. At Pearl Lemon Accountants, we specialize in uncovering hidden risks, from fraudulent transactions to improper accounting practices. Our forensic auditing services provide you with the clarity and confidence to protect your financial integrity.

Whether you suspect fraudulent activity or simply want peace of mind, our team of experts will dig deep into your financials, identify discrepancies, and offer actionable insights to keep your business secure and compliant.

How We Conduct Our Forensic Audits

We don’t believe in guessing games. We believe in hard, actionable data. Here’s how we get the job done:

We Start with a Conversation

Before we pull out any files, we first have an open, honest conversation with you. We’ll ask about your concerns, and what brought you to us. Maybe you’ve noticed irregularities, or maybe you just want peace of mind.

Either way, we’ll customize the audit to meet your needs. We’ll walk you through the process and outline the potential risks based on your industry and business size.

We Dig Into the Data

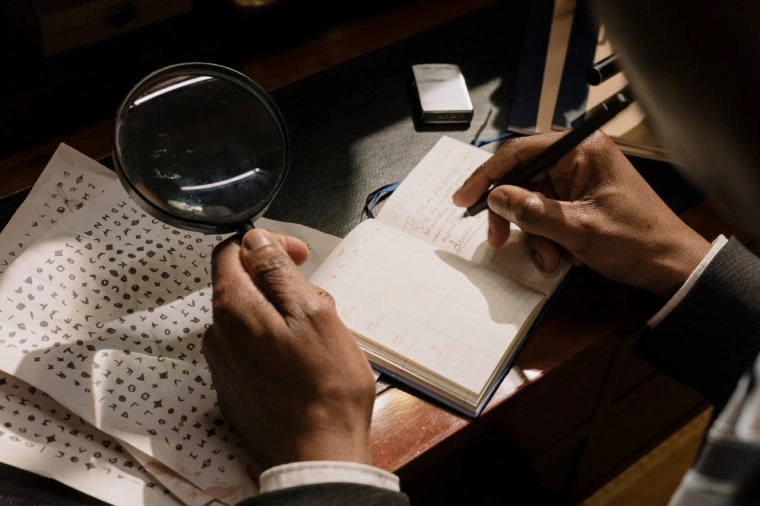

Here’s where we get our hands dirty. We use forensic accounting techniques that go beyond the standard financial review. Think fraud detection via detailed document analysis, transaction tracing, and scrutinizing every financial record.

We dig deep into ledgers, internal communications, emails, payment histories, and more. We’re looking for discrepancies, irregularities, and anything that doesn’t quite add up.

If there’s fraud happening, we’ll find it. If there’s financial mismanagement, we’ll expose it. Our forensic audit is designed to uncover hidden risks that could jeopardize your financial health.

The Results – No Jargon, Just Facts

When it’s all over, we don’t deliver a 200-page report filled with jargon you don’t understand. We break it down clearly. You’ll get a report that tells you exactly what we’ve uncovered, how it impacts your business, and what to do next. It’s not just a summary—it’s an action plan, customized to your company’s unique needs.

This isn’t your typical audit. We’re forensic accountants. We dig deep, we investigate, and we protect your business.

Meet Our Forensic Auditing Experts

Our team isn’t just knowledgeable; we’ve been through the trenches of fraud investigation, financial misconduct detection, and regulatory compliance. We’ve seen it all, and we know how to find what’s hidden.

When you work with Pearl Lemon Accountants, you’re working with experts who understand the nuances and complexities of forensic audits. We’ve handled everything from fraudulent vendor invoices to embezzlement cases, and from misreported earnings to complex money laundering schemes.

We’re a tight-knit team with years of experience in a variety of industries. Our forensic accountants are highly skilled in financial crime investigation, asset tracing, and dispute resolution. We’ve worked across a range of sectors, including:

- Healthcare: Detecting fraudulent billing practices, overcharging, and misappropriation of funds.

- Construction: Identifying fraudulent claims, misused project funds, and inflated billing.

- Real Estate: Exposing fraudulent property transactions, misrepresented rental agreements, and overinflated property values.

- Retail: Investigating internal theft, supplier fraud, and financial mismanagement in complex retail operations.

Experience You Can Trust

Here’s why Pearl Lemon Accountants is the right choice for your forensic audit:

- Industry Expertise: We know what to look for, whether it’s a fraudulent accounting entry, misreported transactions, or illicit financial practices.

- Advance Tools: We use the latest data analytics tools and forensic accounting software to dig deeper than traditional auditors.

- Proven Track Record: We’ve uncovered everything from fraudulent activity to tax evasion schemes. You can trust us to get to the bottom of the issue.

Benefits of Choosing Us for Forensic Audits

Customized Audits That Fit Your Business

No two businesses are the same. That’s why every forensic audit we conduct is customized for your specific needs. We understand the challenges your industry faces and adapt our approach to uncover the truth in your financials.

Confidentiality Guaranteed (Your Secrets Are Safe)

We’re dealing with sensitive information here—whether it’s allegations of fraud, mismanagement, or irregular transactions. We treat your business with the utmost confidentiality, ensuring that all information stays secure. You can count on us to maintain client confidentiality and discretion at every step of the process.

Quick and Reliable Results

We understand you need results fast—without sacrificing quality. Our forensic audits are efficient, without cutting corners. We deliver reliable results quickly, providing you with the information you need to make informed decisions about the future of your business.

Ready for a Forensic Audit? Here’s How to Start

The first step toward financial security is simple—reach out for a free consultation. Whether you’re worried about a potential fraud issue or just want to be proactive about your business’s financial health, our forensic audit team is ready to assist.

We’ll discuss your concerns, review your current financial situation, and set up a plan that’s right for your business. From there, we’ll start our detailed analysis, uncovering every potential risk to your bottom line.

Take Control of Your Financial Security Today

Don’t wait for the storm to hit. With our forensic auditing services, you can identify risks before they become major issues. Pearl Lemon Accountants is ready to help you take control of your finances and uncover the truth behind your numbers. Schedule your free consultation now, and let’s ensure your business is financially secure for the future.

Frequently Asked Questions (FAQs)

We utilize advanced forensic accounting techniques to trace suspicious transactions, reconcile financial discrepancies, and uncover fraudulent activities. By examining documents like invoices, contracts, and communication records, we can identify inconsistencies that point to fraudulent activity. We also use data mining and financial modeling to uncover hidden risks.

While traditional audits focus on verifying the accuracy of financial statements, forensic audits are more investigative. A forensic audit digs deeper into a business’s financial records to identify illegal activity, fraud, or financial mismanagement. Forensic auditors use specialized techniques like fraud detection analytics and financial forensics to uncover hidden discrepancies.

Absolutely. Our forensic audits are designed to provide legally sound evidence that can be used in court, whether it’s for litigation support, criminal investigations, or regulatory compliance issues. If necessary, we can provide expert testimony to back up our findings.

The timeline for a forensic audit varies depending on the complexity of the case. Typically, forensic audits can take anywhere from a few weeks to several months. However, during the initial consultation, we’ll give you a clear timeframe based on your business size and the scope of the audit.

After the forensic audit is completed, we provide you with a detailed report of our findings, highlighting any fraud, mismanagement, or discrepancies we’ve uncovered. We also provide actionable recommendations to address these issues, whether it’s recovering misappropriated funds, implementing stronger controls, or correcting accounting errors.