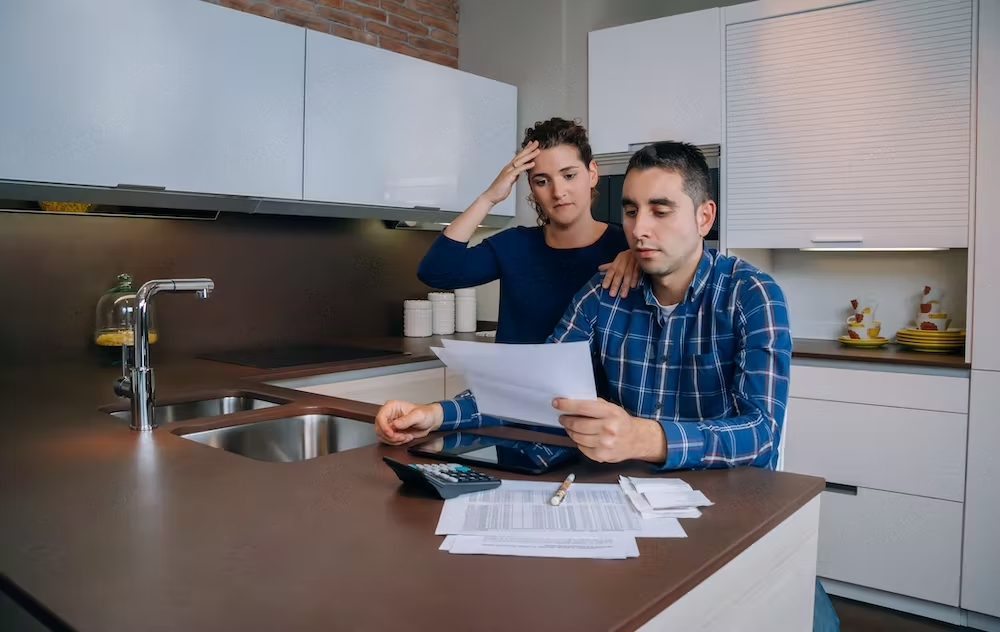

Do you ever wonder what your net assets are? Are you interested in getting a better understanding of how to calculate them?

Accounting can be overwhelming and daunting, but understanding your net assets doesn’t have to be.

This article will discuss the basics of calculating your net assets and provide useful tips for accounting for them. We will also explore some key concepts to help get you on the path to tracking your financial health.

So read on if you’re ready to calculate your net assets!

The Accounting Formula

Accounting is a crucial aspect of every business. It helps track an organisation’s financial health by recording, analysing, and interpreting financial transactions. However, accounting can confuse those unfamiliar with its principles and formulas. One of the most fundamental concepts in accounting is the accounting formula.

The accounting formula represents the relationship between assets, liabilities, and equity.

The accounting formula states that assets equal liabilities plus equity. This means that all resources owned by a company (assets) should always be balanced out by its obligations (liabilities) and claims from owners (equity).

The formula serves as a guide to ensure that all financial transactions are recorded correctly and that the balance sheet remains balanced. Understanding it is essential for making informed decisions about a company’s finances and measuring your net assets.

Asset

Assets are an important concept in the world of accounting. But what exactly are assets? Simply put, an asset provides value to a business or individual. Assets can come in many forms, including money, property, and goods.

In accounting, assets allow businesses to track their resources and understand their financial position. For example, if a company owns a building they use for their operations, this would be considered an asset on their balance sheet.

Other examples of assets could include vehicles or equipment used in production processes.

To properly manage assets, it’s important to understand their value and how they contribute to the overall success of a business.

By accurately tracking and managing assets through accounting practices, businesses can make informed decisions about investments and future growth opportunities.

Liability

In simple terms, liability refers to any financial obligation or debt an individual or business owes to another party. These obligations may include loans, taxes, employee salaries, warranties on products sold or services provided.

Understanding liability is crucial for businesses because it affects their financial statements and balance sheets. When a company takes on liabilities, it must ensure they have enough assets to cover those liabilities in case of default or bankruptcy.

Companies must carefully manage their liabilities to avoid exceeding their assets and ending up in financial trouble.

There are two types of liability: current and non-current.

Current liabilities are debts that must be paid within one year, such as accounts payable or short-term loans. In contrast, Non-current liabilities are debts payable for more than one year. It includes long-term notes payables and mortgage payables.

Equity

Equity is a fundamental concept in accounting that refers to the residual interest of an entity’s owners or shareholders after deducting its liabilities.

Equity represents the capital invested by the owners and profits earned over time, making it a crucial metric for evaluating an organisation’s financial health. Equity is typically broken down into contributed capital and retained earnings.

Contributed capital refers to the money invested in a company by its shareholders through common stock, preferred stock, or other equity instruments.

Retained earnings refer to profits accumulated over time and not distributed as dividends to shareholders. These earnings are reinvested in the business for growth opportunities or used to pay off debts.

The Net Assets

Accounting is a complex field that involves meticulously recording financial transactions to ensure accurate reporting. One of the fundamental concepts in accounting is net assets. In simple terms, it is what remains after all debts have been paid off.

Net assets are essential for organisations because they provide insight into their financial health and liquidity. Positive net asset values indicate that the company has more money than debt, while negative net asset values suggest the opposite.

Additionally, changes in net assets over time can reflect whether a company is growing or shrinking financially.

It’s important to note that there are different types of net assets, including unrestricted, temporarily restricted, and permanently restricted. An organisation can use unrestricted funds without restrictions from donors or other sources.

Calculation of Net Assets

Calculating the net assets of a business is an essential part of accounting. Net assets are the residual interest of a company in its assets after deducting liabilities. This figure is important for investors, creditors, and management as it gives them an idea of the business’s financial health.

Here is the formula for net assets:

Net Assets = Assets – Liabilities

Increasing and Decreasing Net Assets

Net assets are a critical aspect of accounting that every business owner and manager should be well-versed in. This value can be positive or negative, depending on the organisation’s financial health.

One way to increase your net assets is by increasing your revenues while keeping costs low. To achieve this, businesses can explore various options such as increasing prices for goods or services, expanding their customer base or introducing new products into the market.

A reduction in expenses through streamlined operations will also help boost net assets.

On the other hand, decreasing net assets may occur when a company experiences losses or faces increased liabilities. This could happen due to poor sales performance, unexpected expenses or economic downturns.

Conclusion

In conclusion, calculating net assets is an important part of accounting and business analysis. Net assets give a snapshot of the company’s current financial situation, allowing decision-makers to make informed judgments on future investments and decisions.

It is important to understand the various components that calculate net assets, such as liabilities and owner’s equity, so owners can accurately assess their company’s performance. With the right knowledge and resources, anyone can calculate net assets to gain insights into their financial standing.

FAQS

What is the difference between gross and net assets?

Gross assets are the sum of all the assets a company owns and have on hand. Net assets are the difference between what a company owns and its liabilities.

How does an asset value by market value differ from one by book value?

Asset value is the price at which an asset can be sold. The market value of an asset is the price at which it can be bought and sold in the market.

Book value is a financial term that refers to the number of assets an organisation owns and owes on its balance sheet. Book value is calculated by subtracting liabilities from total assets.

What is the difference between net worth and gross worth?

Net worth is calculated by subtracting liabilities from assets. Gross worth is calculated by subtracting liabilities from assets and then adding debt.

Net Worth = Assets – Liabilities

Gross Worth = Assets – Liabilities + Debt